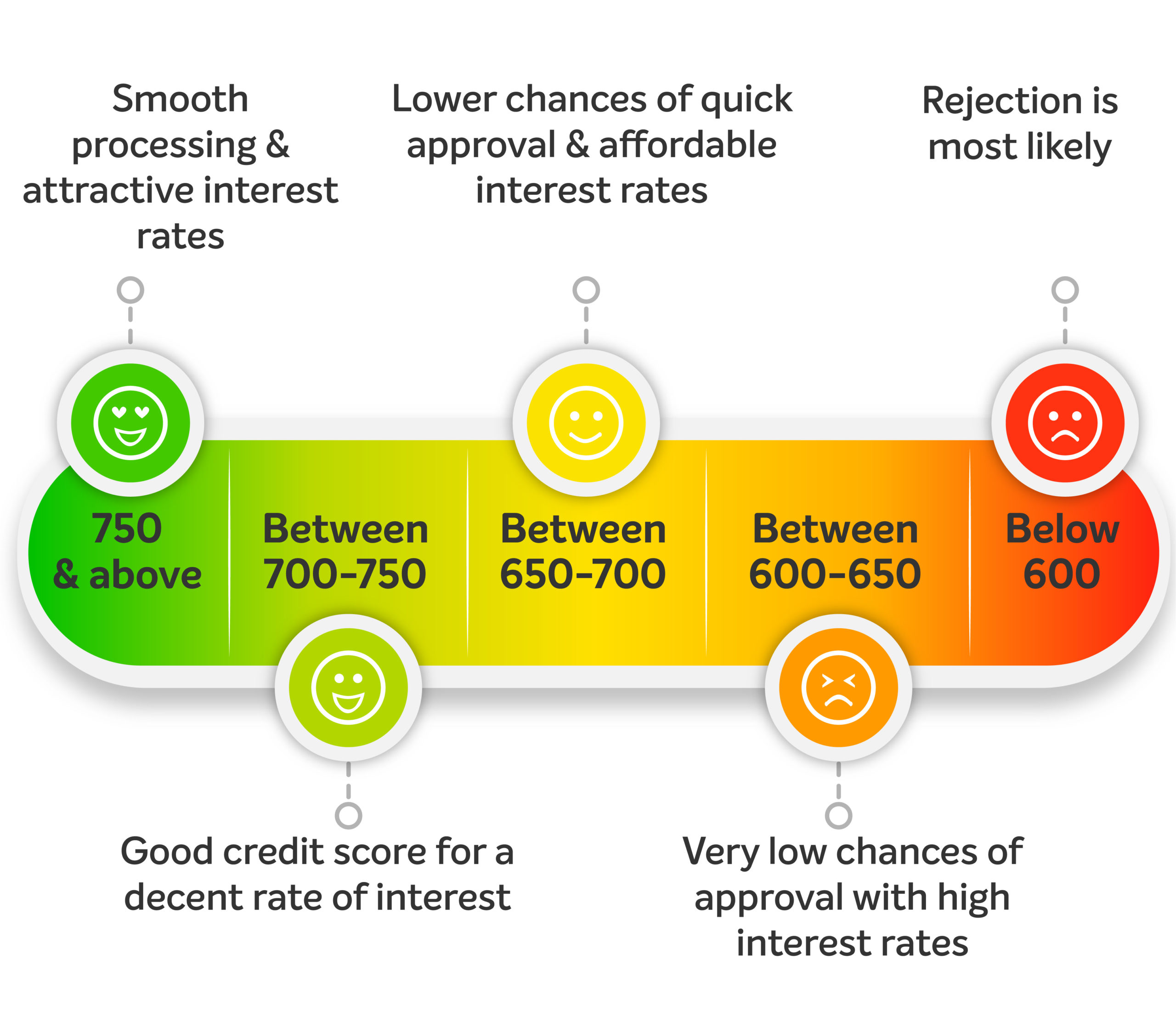

The information on your credit report impacts your credit score both in a positive and negative sense. Your credit score is a tool which lenders take into consideration to determine your ability to obtain credit. Poor credit score will either keep you at bay from obtaining credit or place you in a high risk category which means that if your applications are approved for credit, the interest offered to you will be higher than someone with a good credit score and over a time you will pay thousands of rupees in interest rates.

Let’s see some ways by which you can improve your credit score.

1 Pay your bills on time

It might seem like obvious advice, but this is the most important aspect of your credit history as this is a most common piece of negative information that appears on people’s credit reports and is always responsible for major drop in credit scores. When it comes to a loan or credit card, it is most essential that you make at least minimum payments in a timely manner each and every month without any exception.

If you are late or skip one or more mortgage or home loan payments then the impact on credit report and score will be considerable but defaulting or making late payment on other types of loans will have a the worst impact on your credit score that will stay a longer on your credit report.

In nutshell, the easiest and most approachable thing you can do to protect your credit report and credit score is simply pay your bills on time.

2 Keep your credit card balance low

The payment history on those credit card accounts also impacts your credit score on which you have either skipped or defaulted. Another factor which is considered in calculation of your credit score is your credit card balance. It means having a balance of 35% or more on your overall credit limit, on each card will impact you in terms of lowering your credit score, even if you make your payment on time or regularly pay more than the minimum due. One good strategy is to use your credit card in absolute need rather than using it.

3 Build a Credit History and don’t close unused credit card

Your score calculation also depends on your credit history. The longer your credit history, the better impact it will have on your credit. You will be rewarded for having a positive, long term credit history, even if the account is inactive or unused. This will not only help you to maintain credit score but also help in future when you are going to apply for a loan or credit card, because you will be considered a low risk profile due to your positive credit history. So do not close unused credit accounts even if they are inactive.

4 Apply and open New Credit line, if it is needed

Many people have a tendency to inquire for new credit every now and then, regardless of whether they need it or not. Did you know that putting too many inquiries for credit can harm your credit score? This is not a sign of a good profile as you are assumed to be a credit hungry person. You would have noticed that in malls and multiplex there are many companies promoting credit cards, and you just need to fill up a form for that, such activities also cause a bad impact on your credit score. Before applying for a credit card, read the fine print. Determine what your interest rate will be and fees are associated with the card.

Multiple inquiries in several months can have a toll on your credit score, for you it is just a trial but for your credit history it will settle down all your inquiries in your credit report which will be detrimental to your credit score. So apply for new credit when you are in absolute need of having it.

5 Dispute the inaccuracies

The best way to keep your credit report error free is that you carefully review all four of your credit reports and correct any inaccuracies or outdated information that is listed. If you spot any incorrect information/ the account is not yours/multiple entries of the same account, raise a dispute with your creditors or with the credit bureau. In Chapter 6 we already have seen the common credit report errors which will negatively impact your credit score.

It is best to hire a Credit Repair Professional Service to deal with all your inaccuracies as they are experts in this domain. It takes 10 to 30 days to rectify minor errors but for major errors, time will vary depending on the case. If you delay in fixing all these errors, the result of your credit score becomes low.

6 Avoid Excess Inquiries

Every time you apply for a loan or credit card, a lender or creditor pulls the credit report and makes an inquiry with one or more of the credit bureau (TransUnion CIBIL, Equifax, Experian or CRIF High Mark). This enquiry information gets added to your credit report and stays there for a longer period of time. Single inquiry will have slightly less effect on your credit score but if you have multiple inquiries in a short period of time, then it will drastically reduce your credit score.

Excessive inquiries in a short period of time will lower your credit score and decrease your chances of getting approved. Hence, avoid excess inquiries.

If you have a well maintained or above average credit score, above listed ways will help you to maintain it and give a boost to your credit score but make sure you follow all to achieve desired results.