Fuel in India has never been cheap, at least the one for automotives. But the recent tax-driven hikes ruin the benefit of affordable mobility in the world’s largest small car market which has perhaps the most fuel-efficient cars in the world. The government needs to understand the advantages of affordable fuel as the country is far beyond and much more than the metros and cities. Letting loose fuel prices like a wild beast will be self-destructive. Mobility is the fulcrum of the economy. Affordable energy and fuel is a right in the new and emerging economy and should not be an administrative concession

After rising 26 paise to Rs 100.13 per liter in Rajasthan’s Sri Ganganagar in February, retail prices for standard gasoline reached triple digits nationally for the first time, while diesel rose 27 paise to Rs 92.13 per liter, based on data available from the Indian Oil Corporation. This was the ninth day that the price of gasoline and diesel rose in a row. Gas rates are taxed by both the federal and state governments and vary from state to state.

In April 2020, crude oil prices plummeted because of declining demand during the pandemic. However, the cost has risen from $ 40 a barrel to about $ 64 since the advent of vaccines. On the other hand, to increase oil prices, Saudi Arabia, one of the world’s leading oil-producing countries, has cut its daily production by 1 million barrels by February 2021.

The main reasons for the recent round of gasoline and diesel price increases in the country are the stabilization of international crude oil prices and extremely high taxes on fuel. The recent spike in international crude prices, as the world’s third-largest oil importer, has hit India hard, where citizens pay extremely high fuel tariffs compared to neighboring countries. The price of Brent crude to date is 63.21 dollars a barrel.

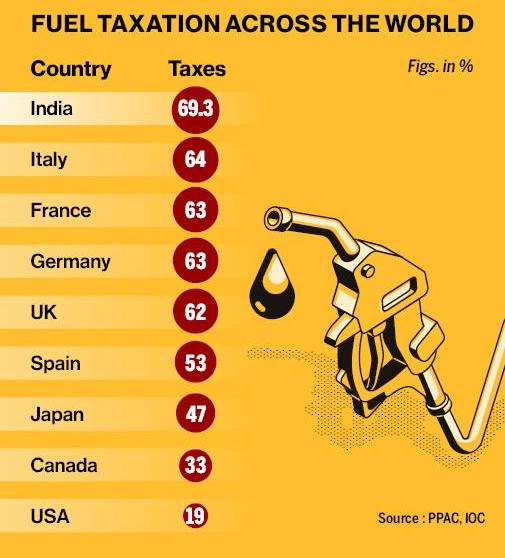

84% of India’s national crude oil needs are imported by India, so the price fluctuates according to world demand. Initially, the impact of COVID – 19 on the economy and the decline in fuel demand led to a drop in global oil prices. Prices are slowly trending upward now that the market is recovering. The prospect of a COVID – 19 vaccines being developed is also a major reason for economic optimism. As the coronavirus is hitting the economy hard, to try to overcome the situation, state governments have increased tariffs on gasoline and diesel. Taxes account for 69 percent of the total price of gasoline we pay as consumers. The excise tax on gasoline, for example, has risen from Rs. 19.98 at the beginning of the year to Rs. 32.9.

The exchange rate has a profound impact, from a purely economic point of view, on the amount of oil India can buy on the international market. This means we are Being able to buy the same amount of oil as before with less oil. By contrast, to import the same amount of oil, the government needs more money. Currently, the prices of gasoline and diesel in the state capital are unchanged at 90.40 per liter and 80.73 per liter, respectively, from last week. The petrol and diesel tariffs in Mumbai were 96.83 per liter and 87.81 per liter, respectively.

The price increase is due to tax increases by the center and the state to make up for the loss of income during the blockade. Increasing prices for downtown excise taxes and state government sales tax. To balance the budgetary situation, the tax collected is used by the central government. With 69%, India is one of the nations with the world’s highest fuel tax, followed by Italy with 64% and the United States with at least 19%.

The heat from higher gasoline costs is already felt by people with higher travel expenses. A direct effect of raising diesel and gasoline rates on your everyday commute is increasing your monthly fuel expenses. There will be a rise in the cost of transporting vegetables from farm to market. This can be reflected in prices for commodities. Taxes and other taxes include over two-thirds of the premium you pay for petrol. The retail price of fuel in India is also much less influenced by the change in the price of crude oil.